So two years after my last post Getting My Finances Straight June 2018 my financial position has improved somewhat 🙂

Back in 2018 I had just started on my path to getting my finances back on track — and I can honestly tell you that there’s a big difference between saying you’re going to do something.. and then actually doing it.

By starting off with writing it all down,,, all the amounts outstanding, the rates I was paying, the terms of lending agreements etc it brought it all home to me the mess that I was in.

Being self employed for 30 years and having irregular income and badly managed personal finances had really taken a toll on my life, and without getting my act together I was looking at an increasingly bleak future.

Two years ago I had credit card debts of £33,000 ($45,000), a bank overdraft of £10,000 ($12,000), a car finance agreement costing me £300/month, and an interest only mortgage on my house with an expensive interest rate of 6.5%. Could I really be in a bigger mess ? The only thing two things that were going right for me at the time was being married to a lovely kind understanding woman, and the fact that I’d given up self employment and gotten myself a really good company job.

So since my last update my biggest success has been ditching £33,000 ($45,000) of credit card debt.

I managed this by persuading a wealthy family member to purchase a run down property and agreeing that I would do the place up, and that in exchange for my efforts we would split the profits. Given my previous track record of being bad with money it took a bit of persuasion but I had a good deal on the table, with little chance of losing money and a great chance of making a good return in a short period of time.

So she bought a dilapidated house for £90,000 that had been re-possessed by a bank, and last year we sold it for £155,000 – a nice tidy profit for me of £30,000 and it neatly paid off my credit card debts in one go. I am eternally thankful that she enabled this opportunity as without this I would have struggled to have succeeded to the point I have.

This sounds easy (get someone else to buy a house and I do it up and we split the profits) and everything worked out very well, but believe me I put blood sweat and tears into that project and I earn’t every penny of it through the long hours and effort I put in. It consumed my life for 6 months, I didn’t enjoy doing it, and it put a real strain on my job and domestic relationships – I wouldn’t do it again. Property development might sound like a great idea, and some people enjoy it ,, sadly not me.

So the great thing is now I’ve got rid a massive financial millstone that was hanging round my neck.. all that credit card debt, and the £1,00+ monthly repayments that went with it.

For years I’d just mentally block out the fact that I had these huge credit card balances, but once I’d decided to sort myself out and get rid of it, I often found it hard to sleep at night knowing it was there.

I also had the pleasure of my 3 year car lease agreement coming to an end last summer . Instead of shelling out £300 a month for a lovely new car – I decided to not go down the lease hire agreement route again and instead I bought myself a 12 year old car with 112,000 miles on the clock for £1,200. This has also freed up another chunk of money each month. I no longer drive around in a big shiny new car, instead I drive round in a reasonable looking old car, that I don’t owe a penny on, and is cheap to run and insure.

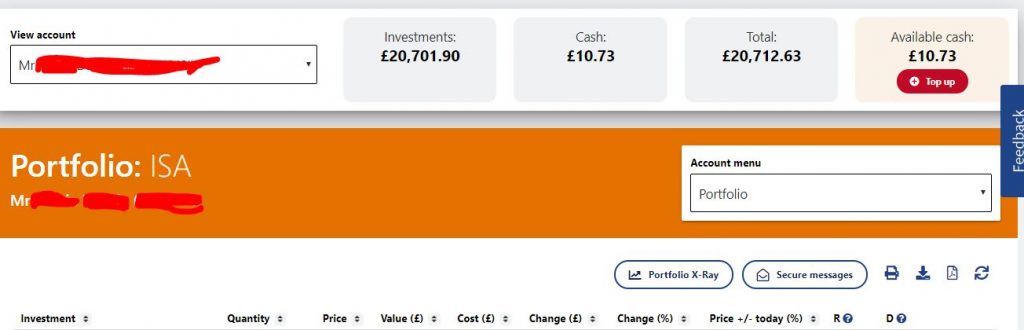

Now that I am no longer paying off card balances, and no longer have car finance payments to make I have been making serious inroads into my bank overdraft and have reduced it from £10,000 to only £1,500 and expect that this will be cleared by the end of this summer. I’ve also increased the amount I save into my investment accounts each month, and before the recent falls in the stock market caused by the Corona Virus I had investments to the value of £24,000 ($29,000).

I’d had a good run on my stock market investments, but this obviously came to a recent halt. I also made mistake and selling out into cash at exactly the wrong time, panicked by market falls caused by Corona (ahh the benefit of hindsight) but I’d stuck to my plan for the last two years of investing a set amount each month, on the day that I got paid, and building up a fund for my future – and built up quite a bit of a fund.

I made the classic mistake of being panicked into selling and then finding that I’d sold at the bottom of the market…. So I’m still not that much of a clever clogs with money am I?

I will write a post about my investment success and subsequent failure in the next few days to share with you whats gone on.

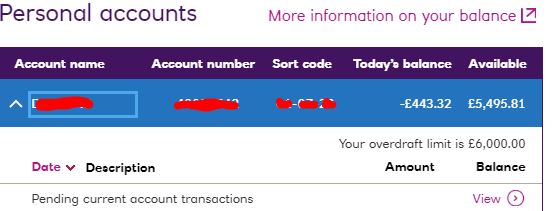

But here’s a snap shot of my bank current account below.

My overdraft is down to only minus £500, and I still have a buffer of £5,500 if I need to draw on it. My ambition is to run a positive balance of £3,000 and then transfer all monthly surpluses into my investment accounts. My wife who is much better with money than me has a current account balance that never falls below £5,000 and I consider this to be our family emergency cash. Over time I hope to increase my current account balance to a similar level, but for don’t see it as a pressing priority.

My Investment ISA account is looking much better, I will write another post soon going into my investments in greater detail.

I’m also pleased to tell you that the company I work for have enrolled me into their pension scheme. Its quite generous, I pay in 4% of my monthly salary, the government pay in 1%, and my employer contributes 7%. Even though I’ve never had a pension before (I’m a very very stupid man) the generous contributions by my employer mean that I might in future years have quite a nice pension to help me once I retire.

Next week I have a meeting with my bank to look at my mortgage and how I can transfer it onto a better deal. I took out my current deal 12 years ago on an interest only self certified deal – as i was self employed. It was the only deal available to me then as I was self employed. Its expensive at an interest rate of 6.5%, I’m not making any capital repayments and now as other areas of my finances have improved its time to sort my mortgage out…. this gives me yet another opportunity to write a page for you on how things progress.

Wow … that’s a lot of getting stuff off my chest. I will finish by sharing this….. my current statement of financial account.

June 2020.

Monthly Salary (after tax) £2,800

Current A/c -£444

Investment ISA A/c +£20,712

Mortgage Balance -£105,500

Credit Cards £0

Car Finance £0

Other Loans £0

June 2018.

Monthly Salary £2,600

Current A/c -£10,000

Investment ISA £0

Mortgage Balance -£105,500

Credit Cards -£33,000

Car Finance -£3,600

Other Loans £0