2020 About Me Mike 54 years old, Manchester. Husband of one, Father of three Homeowner who has moved from a very expensive interest only self cert mortgage at 4.4% to a capital and repayment mortgage at 1.9% Didn't start a pension until last year - but now saving over £400 and month through company pension scheme so now have just over £5k in there, and its building. The dream job that I started in 2018 is slowly becoming a chore, and my mind and ambition is wandering a little. … Read More........ about About Me

Main Content

Making Some Money From Ebay and Adsense

So, a little over a year since my last post… I’ve started making a bit of money from my Google Adsense and from selling some fishing tackle on Ebay.

More than i thought I would to be honest.

So I’ve traded now for just over a year and taken the big step of incorporating a Ltd Company – to separate these activities from my daily living, and to separate them as a tax entity.

Lots has happened – turnover is beginning to flow.

I’m going to write a decent full disclosure warts and all post in the next week or so and share the highs/lows and the pounds shillings and pence that I’ve made.

Making Money From Fishing

I’ve been mad keen on fishing since as far back as I can remember. My dad loves going fishing, and he still gets out every year at age 84 ! My grandfather was a very keen trout fisherman, as was his father and so on. My dad reckons we’ve been fishing mad family for generations.

When I was a kid (many many years ago) all I thought about, dreamed about, wanted to do — was go fishing.

But a rotten north of England inner city education, and parents who didn’t really push me to achieve at school meant that I went fishing a lot, and studied little.

I always dreamed about being a professional fisherman, and making my living from fishing, but it has never been on the cards as I’ve just never figured out how to do it. I now make a very good living from fish related ecology – but its not fishing.

So, now that I’m no longer in a heap of debt (£36,000 at one point), and don’t have the worry, stress and pressure that goes with it I think I’m in a position to reconsider how I can make extra income from the hobby I love so much.

I want to start to earn a little extra money each month, that might go on to grow into a new full time income, and enable me to wind down my existing job, and make my income from fishing and also increase my investments that will see me through retirement.

Investments are really the key, as I’m looking to fund my retirement, and will need continuing income beyond the day I actually stop working. The fact that I’m saving £600($800) each month into my investment plan, and another £400 ($500) into my pension plan should see me in good stead. I’ve manged to save £26,000 ($30,000) in my savings plan over the last few years, and my pension which started last year already has £5000($6000) in it. A good start after being in debt for so many years.

Now that my sole focus is not on meeting debt repayments each month, I also have time to think. And this thinking time has enabled me to come to the conclusions that –

- I’m good at fishing

- I’m not good at employing people and business administration

- I write good blog posts

- Not many people read blogs anymore – they’re a thing of the noughties (I think I only write this blog these days as a sort of self confession – and to help me get my thoughts straight- this post is a good example of this).

- Good Vlogs get a lot more traffic than good blogs

- If I had more traffic on my blogs or upcoming Vlog, I can get income from Google Adsense

- I need to ramp up the posting on my existing fishing blog (which currently gets only a trickle of traffic)

- I need to start to create a Vlog for my fishing blog, and run both Blog and Vlog side by side to increase traffic.

- I need to set up an online shop on my fishing blog, so that I can sell the items of fishing tackle I use to other anglers. If I can get more traffic to my fishing blog and vlog, it should be relatively simple to drive customers to my online fishing stores.

- I need to set up

- an ebay shop – if I’m going to sell fishing kit on my blog and vlog, then I can also sell it on Ebay (and maybe later on Amazon too)

- I don’t want to be a drop shipper, It pisses me off that people are flooding ebay with items that they don’t own, and take weeks to deliver. I’m definitely in the group of people who wants to buy something and have it delivered quickly. That’s why I have an amazon prime account.

- I need MORE TRAFFIC ! Traffic = Adsense and product sales.

So in a nutshell – I need to get more traffic, open a couple of sales channels. Easy to say but probably a lot of effort involved to actually do it.

My Traffic

My traffic stats for July 2020

Fishing Blog 858 – page views

Fishing Youtube Channel 77 Subscribers / 1,717 views / 37 watch hours

Fishing Site 2 9,944 – page views

Getrichwithme Blog 31 – page views

Getrichwithme Vlog 0 Subscribers/ 0 views / 0 watch hours

Ebay Shop Traffic 17,996 Impressions / 133 page views

Online Shop Traffic 0 Views

My Sales/Income

My Sales/Income for July 2020

Ebay Sales 0

Ebay Net Income 0

Online Shop Sales 0

Online Shop Net Income 0

Adsense Income 0

Total Net Income 0

Tax (20% income tax)

My Income (money in my pocket) £00.00

Looking Forwards

So now my £30,000 ($40,000) debt is now a thing of the past – its time to start looking forwards to the future.

I’ve just passed my 54th birthday and its time I think about how I would like to spend my working years before slowing down and retirement.

My current job is great, it pays me a good income £43,500 a year, however it should be very fulfilling (ecology) but because of the endless amount of paperwork, emails, meetings, health and safety and other palaver — its just not the job or lifestyle I hoped that it would be.

I suppose just like everyone else – what starts out to be a great job just ends up as a drudge. No matter how exciting the job is to begin with, it just turns into a drudge and we wistfully look elsewhere for interest and new excitements.

Mrs Getrichwithme asked me when I was intending to retire, and my official retirement age is 67, but i said i reckon that i can retire in 8 years time when I’m 62, especially if I can continue to sock away a thousand quid a month. I currently contribute £400 a month to my pension and £600 a month into my investment ISAs. I think theres about £5000 in my pension, and theres £25,000 in my investment ISAs… its nice to a bit of money behind me at last.

But then I’ve been thinking (a dangerous thing at times) that if I can make a bit of extra income on the side from my hobby of fishing (I am a well known angler in my local area) then it can help towards my goal of retiring at 62, or if my new fishing income streams take off, then it could result in my finishing my official job even earlier and let me just concentrate on my fishing …. which is what I intend to do during retirement anyway.

So … I’ve already been a little busy.

Back in 2008 I started to write about my fishing adventures in a blog using the google blogspot.com service. It proved to be really popular at the time, and in 2015 I realised that I’d had over 3,000,000 visits, and over 500,000 hits on my google profile. Then I did a move that I’ve come to since regret – I decided to monetise my fishing blog to take advantage of all the traffic I was generating thinking that it would help me get out of the debt situation I’d found myself in. But it didn’t work – I bought a new domain with a virtually identical name to my blogspot blog name… and transferred all the files, documents and pictures over to my new domain and hosting package… and then instantly lost 99% of my traffic. No one could find my blog anymore, It didn’t rank highly in search engines anymore, and my dreams of making a packet from google adverts disappeared down the pan.

Duh.

So fast forwards to 2020, I still go fishing, and I still regularly blog about fishing, and have a small but regular readership. In my local area I am a recognised go to authority on fishing. But I don’t make any money from fishing, despite recreational fishing being worth £1.5bn ($2billion) to the UK economy and employing over 27,000 people.

So how do I go about getting a slice of this potentially valuable fishing cake ?

At present my blog gets only about 800 hits a month (less than that if I don’t post new material), my Google Adsense revenue is zero (my adverts have lapsed), and I have no payed advertising for local fishing businesses on my site.

I have a Youtube Channel in the same name as my blog,where I share a few interesting clips from time to time, but only have 75 subscribers, and my watched hours are very low.

So……. I am going to devise a plan to make some money from my hobby – the thing I am most passionate about in life, and have in depth expert knowledge about. — What can go wrong ?

So the plus is that I am a recognised authority on my sport (but only in my local area), I have a blog, I have a few technical skills around internet publishing, and I now have a bit of cash and time to throw at a new project.

This project is called “Make money from fishing, so that I can retire early and do more fishing!” …. simple eh — what can possibly go wrong.

And thats going to lead to my next blog post which will be entitled “Making money from fishing so I can retire early and do more fishing”.

Getting Rid Of My Overdraft

Clearing my overdraft

June 2020 – I’ve now got my monthly overdraft down to only £450 – a marvelous effort from the £15,000 of summer 2018.

June 2018 — read below….

I have a short term ambition – to clear my overdraft which has over the years seen me go £15,000 into the red on a frequent basis.

Now that I’m no longer self employed – there is simply no excuse for hitting the red every couple of months. My income whilst self employed was comprised of infrequent but large pay checks. My bank we’re happy to cover the gaps but charged me for the privilege. Now that line of work has dried up, I ended up maxing my overdraft and credit cards out… Now I have to start paying it all back. (my overdraft as of June 2018 stands at just over £10,000 at an interest rate of 35%)

Last month I managed to scrimp my way to a £500 monthly surplus – as I had some back paid work expenses hit my bank account and I’m expecting a further £300 this coming month to come back my way.

That’s going to leave me another £700 to find to get back to staying in credit/in the black at the end of each month.

Today is the 19th August – my ambition is to raise as much extra money as I can by my next pay day on the 20th September by selling off my unused sporting equipment and other assorted goods and junk. Anything I make that’s in excess of the amount needed to clear my overdraft by the 20th September (payday) is going to be put into a new stock/futures trading account.

Ebay is my preferred way of selling off my unwanted stuff – I’ve tried out a few car boot sales over the years and find them to be very frustrating – people make ridiculously low offers on things that I’m trying to sell, I always drive out feeling as though I’ve given my stuff away.

Even though the fees from Ebay/paypal when combined hit about 20% of the sale price of my stuff – at least I feel as though I will be able to set a fair price.

So lets see how I get on – and I will keep updating this page for the next month showing what I’ve sold and how much I’ve received for it.

(current value of investment account £1600)

My Investment Process

My Investment Process is really simple.

My local banks in the UK currently give interest on accounts at around 1% – which is in reality a negative investment when you consider that price inflation is currently around 2.3% … so saving in a bank account and losing 1.3% a year doesn’t appear to be any sort of option

I have had my fingers burnt in the past when investing in individual shares. It was great fun, but the lessons I learnt were all about not have my eggs all in one basket, and also that information is key – and companies can be rather economical with the truth about their true financial position….. Individual investors are always the last to know when things start going wrong.

I’m still a big believer in the stock market – as it gives a financial return far in excess of anything that you can get from a high street account and I have no fear of markets. I just allow a professional investment manager do his stuff, spread investments around and prepare to ride out the bad times and enjoy the good ones.

I am currently investing my £400 a month in my stocks and shares ISA in two companies.

Black Rock Smaller Companies investment Trust – London Ticker BRSC.L

and Polar Capital Technology Investment Trust – London Ticker PCT.L

The UK FTSE 100 index gives an average growth rate of 8.07% with dividends re-invested over the previous 10yrs

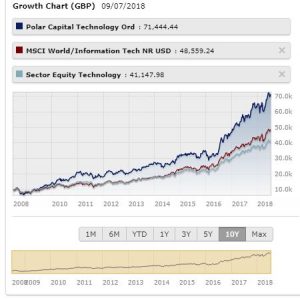

Compare that return with this screen grab of an Investment Trust rank tool from my AJ Bell You Invest account

Click on the image to enlarge – As you can see – the average growth rates over 5 and 10 year periods are far in excess of those from bank savings accounts and even the FTSE 100 average

I decided to pick Black Rock Smaller Companies – on the very basic premise that smaller companies tend to grow faster than large ones. So I invest £400 every other month into BRSC.L which has a 5 Yr av growth rate of 20.03%, and a 10 yr av growth rate of 19.37%

The other investment I make for myself on a bi-monthly basis is the Polar Capital Technology Investment Trust – PCT.L This investment trust gives a 5year av growth rate of 23.59% and a 10yr av growth rate of 21.80%

I’ve only £1200 invested so far, so lets see how they roll over the next few years, and if these fantastic growth rates are maintained

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!